Contents:

Work with your tax accountant now to ensure that your giving plan is win-win. Hannah Cole is both a working artist and the founder of Sunlight Tax, a tax education and preparation service that works with creatives and their businesses. She says that now is a good time to take a beat and figure out the system you’ll use to get those needed documents to the person preparing your taxes. Set up an account on your chart of accounts called ‘Ask my accountant’ to help you easily compile items and transactions that need to be discussed with your accountant. Talk with your accountant to figure out which taxes apply to you and your business.

For small business owners choosing the right accountant can be a lifesaver. These tax-sheltered accounts provide a big tax break and help people establish good financial habits that will pay a lifetime of dividends. Before tax season ends, Cole suggests her clients use an SEC calculator to try out different contribution amounts and different interest rates. Just imagining how much your money will grow can help you get excited about an end-of-year tax strategy that forces you to sock away money for a rainy day. Working with an accountant isn’t just about filing federal, state and local taxes.

Many accountants are only available during normal business hours, Monday through Friday. But some also offer evening and weekend hours to accommodate their clients’ schedules. Ahead, personal finance coach Dawnette Palmore and tax expert Hannah Cole share the top four money-saving questions you absolutely must ask your accountant before tax season ends.

This is valuable because business deductions decrease your taxable income, which will reduce your tax liability. And if in order, get you the largest tax refund possible on your tax return. You won’t want to forget to take all of your allowable deductions! Your accountant knows your business and can offer tax advice on which deductions you should be able to take. Many business owners don’t realize the value of working with an accountant until they’re in the middle of a financial crisis.

Products

Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. An accountant can file and remit your business taxes on your behalf. This includes filing all of those pesky accounting forms and remitting your tax liabilities to the proper agencies. As an employer, you may be responsible for managing workers and contractors, marketing products and services, serving clients, and hiring.

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. Revisit this question from time to time to ensure your business is staying up-to-date with new tax laws and regulations. Although this is a question you can bring up to your accountant at any time during your entrepreneurial journey, you should definitely ask it when you are first forming your business.

If an accountant does not have insurance, they may be personally liable for any damages that result from their negligence. Asking about insurance is a good way to protect yourself from potential financial damages. They may also be able to offer a discount on the software with the services they provide.

Then, you get to take a standard mileage rate set by the government each year that is surprisingly generous. If you drive 100 miles round-trip for a big client meeting, that’s a $58 deduction . Also, Cole recommends that freelancers go the extra mile to make sure that their 1099 forms actually make it to them. “Freelancers should also make a list of everywhere they worked in the past calendar year and check in that they have a W9 on file with their correct mailing address,” she advises. Tax season is the inevitable season that comes every year, whether we like it or not. What you do in the months leading up to this time could determine the size of your next tax bill.

However, an xero livestock schedule can do more than keep your business finances in order – they can also help you make smart business decisions that will help you grow your business. From choosing the right business structure to setting up financial systems, an accountant can offer valuable guidance to help your small business succeed. A good accountant’s goal is to help you maintain and grow your business. To do that, they need accurate and timely financial statements and a client who’s interested in taking their advice—not just during tax season, but throughout the year. So make sure you have your books in order and make time for asking the right questions. Dealing with income taxes can be the most daunting part of running a business.

An Affordable Bookkeeping Alternative to a CFO

If you’re dealing with multiple people, make sure to get to know each one and how they handle your finances. Find out if they have any specialities or expertise that can help your small business. You should also ask about their fees and how they bill for their services. By asking these questions, you can be sure that you’re getting the best possible service for your small business. CPD stands for continuing professional development and is important for anyone working professionally. It helps ensure that professionals keep up to date with changes in their field and new tax laws and maintain their skills.

Accountant Software Market to Set New Heights: Analysis by Key … – Digital Journal

Accountant Software Market to Set New Heights: Analysis by Key ….

Posted: Thu, 16 Mar 2023 08:46:54 GMT [source]

Your preparer may want you to use Google Docs, Quickbooks, Box, or their own secure portal. Whatever that format is, start getting acquainted with it now to save yourself the headache later. Under Sales Transactions, Filter drop-down list, select the Type “Money Received,” and change the date.

Maybe you started as a sole proprietor but could really use the legal protection of an LLC. Or you already have an LLC but could benefit from the tax advantages of an S corporation. The main UK qualification is ACA , a highly regarded qualification that takes three years to complete. When choosing an accountant, it is also important to consider their training and experience. When meeting with an accountant, be sure to ask about insurance. Accountants need professional liability insurance to protect themselves from lawsuits alleging that they failed to meet professional standards.

Ally Interest Checking Account

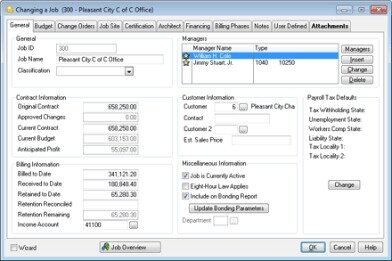

The screenshot in my post is a portion of the detail of the Ask My Accountant account. The items on the bills in question have no connection to the Ask My Accountant account, yet they are showing up there as transactions related to the Ask My Accountant account. Although the items aren’t linked to the Ask My Accountant account, please note that you can select it on the Expenses tab and you can save it even without a value. You’ll want to review these transactions and remove this account.

The items on the bills ARE NOT set up with Ask My Accountant in expense or income. The bills show in the account and do not have any value – not even a 0.00. If your business experiences a loss, you’re no longer able to carry it backward. But you can now carry it forward indefinitely to help offset future income.

Chart of Accounts is a listing of the categories that QuickBooks uses to summarize money movement for your company’s financial statements. If this seems a bit confusing to you, that’s okay—most business owners won’t need to modify this. In fact, unless you have a background in accounting or finance, it’s probably best to leave the Chart of Accounts as is.

However, seasoned QuickBooks users started using this concept before QuickBooks introduced it. It is a great way to not only keep all of your questions organized; it can be useful in other ways as well. Watch the below video for more information on how and why to use the ask my accountant account in QuickBooks. What dogs offer so readily, of course, is precisely what modern American physicians do not. Every year, our system equips us with more medicines to prescribe our patients yet less opportunity to sit down beside them and explain how they should be used.

Can making a donation lower my tax bracket?

And, store them in a secure place (e.g., locked filing cabinet). Catch up on Select’s in-depth coverage ofpersonal finance,tech and tools,wellnessand more, and follow us onFacebook,InstagramandTwitterto stay up to date. You can easily discover if your bank is FDIC insured using the BankFind Suite tool. Eligible deposits at FDIC-member banks are protected for $250,000 or more. We earn a commission from affiliate partners on many offers and links.

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

If you ever want to delete an existing https://bookkeeping-reviews.com/ from your Chart of Accounts, find the account you want to edit on the Chart of Accounts screen. Click the drop-down menu next to the words Account History, then choose Delete. Next, you’ll want to give this account a descriptive name so you can quickly find and use it later.

But if you can find an accountant who comes highly recommended by past clients, chances are they’ll be a good fit for your business. Is the new car purchase for a small business can be considered an operating expense? The car is needed for the transportation of supplies and we plan to put down 50% and finance 50%. Another good account to add is one named “Ask My Accountant.” You can use this account any time you’re not sure which of your accounts to use. To create this account, first navigate to the Chart of Accounts by clicking on Accounting in the left navigation bar. If you don’t have an invoice from the organization itself, credit card and bank statements can work too.